The Hidden “Spreadsheet Tax” on Trade Profitability

In the fast-paced world of HVAC, plumbing, and electrical contracting, profit margins are won or lost in the details, specifically, in materials management. For too long, the humble spreadsheet has masked itself as a cost-saving tool when, in reality, it operates as a hidden “spreadsheet tax” on your business.

This tax is not an optional fee; it’s the financial leakage caused by fragmented, manual, and unreliable material tracking. Industry figures confirm the scale of the problem: inventory tracking failures affect approximately [62% of business finances](https://procurementtactics.com/inventory-management-statistics/#:~:text=According to Supply Chain Dive%2C 62%25 of business finances are,to failure in inventory tracking.). This isn’t just an administrative headache; it’s a systemic barrier that converts potential revenue into unrecoverable operational costs.

The core issue? Spreadsheets are static. They capture inventory at a historical moment and are instantly outdated in a distributed environment where parts are constantly moving between the warehouse, job sites, and service vans. Errors proliferate quickly through manual data entry and formula maintenance. As a result, the data becomes unreliable, leading to three massive cost centers for your trade business.

Cost Center 1: Lost Labor Productivity and the Price of Downtime

Your skilled technicians are your highest-value asset, with billable labor rates often ranging from $100 to $250 per hour. When they are searching for a part instead of installing it, the business pays a premium labor rate to generate zero revenue.

The primary culprit is the Parts Run Penalty. Poor van stock visibility, rooted in manual records, inevitably forces technicians off-site for emergency supply runs. Businesses relying on outdated systems routinely squander 5 to 10 hours per technician every single week on inventory guesswork and parts chasing. This downtime directly limits your capacity to take on new, profitable jobs.

Also, manual systems sabotage the First-Time Fix (FTF) rate. When inventory data is inconsistent, the tech arrives without a critical component. While top-performing companies achieve an FTF rate of 76%, the bottom 20% of organizations struggle at just 55%. That wide performance gap triggers costly callback labor, extra travel, and damaging customer dissatisfaction.

Cost Center 2: Hidden Margin Leaks

Spreadsheets are incapable of keeping pace with the modern volatile commodity market, ensuring that every quote you generate is a gamble.

The Pricing Lag: Material costs, labor rates, and supplier pricing can change overnight. Since spreadsheets require someone to manually update this information, the pricing you use in estimates is almost guaranteed to be lagged and outdated. Global research reveals that 80% of businesses suffered profit loss because their pricing could not keep pace with rising market costs. If your quote is based on month-old data, you will inevitably underprice the job and lose margin, or overprice it and lose the bid.

The Scope Gap: Manual quoting processes often rely on rough estimates instead of precise Bills of Materials (BOMs). This creates financial risk through scope gaps, which are ****missing details like specific insulation requirements or waste disposal costs that are discovered later. These unforeseen costs eat directly into the intended project margin.

Cost Center 3: Capital Erosion from Inventory Imbalance

Spreadsheets drive you toward a constant, expensive inventory imbalance, tying up cash unnecessarily while costing you revenue from stock shortages.

The Dead Stock Burden: Poor demand forecasting, a hallmark of manual systems , leads to chronic overstocking. This unused, slow-moving inventory, known as dead stock, can comprise up to 30% of a company’s total inventory. The annual cost just to house this junk, including storage, insurance, and the labor spent managing it, is estimated at 20% to 30% of its value. This is cash that cannot be invested in growth.

The Stockout Failure: On the other end, understocking critical parts causes immediate financial loss through delays and missed sales opportunities. Because technicians don’t trust the static inventory numbers from the office, they often resort to the “warehouse on wheels” strategy , filling their vans with excess stock “just in case.” This only multiplies your total inventory value, increases operational friction , and still doesn’t guarantee they have the right part for the next job.

The Strategic Solution: Shifting to Proactive Profitability

The choice is simple: continue absorbing the four-figure monthly cost of spreadsheet inertia, or invest in an automated, real-time platform designed for the trades.

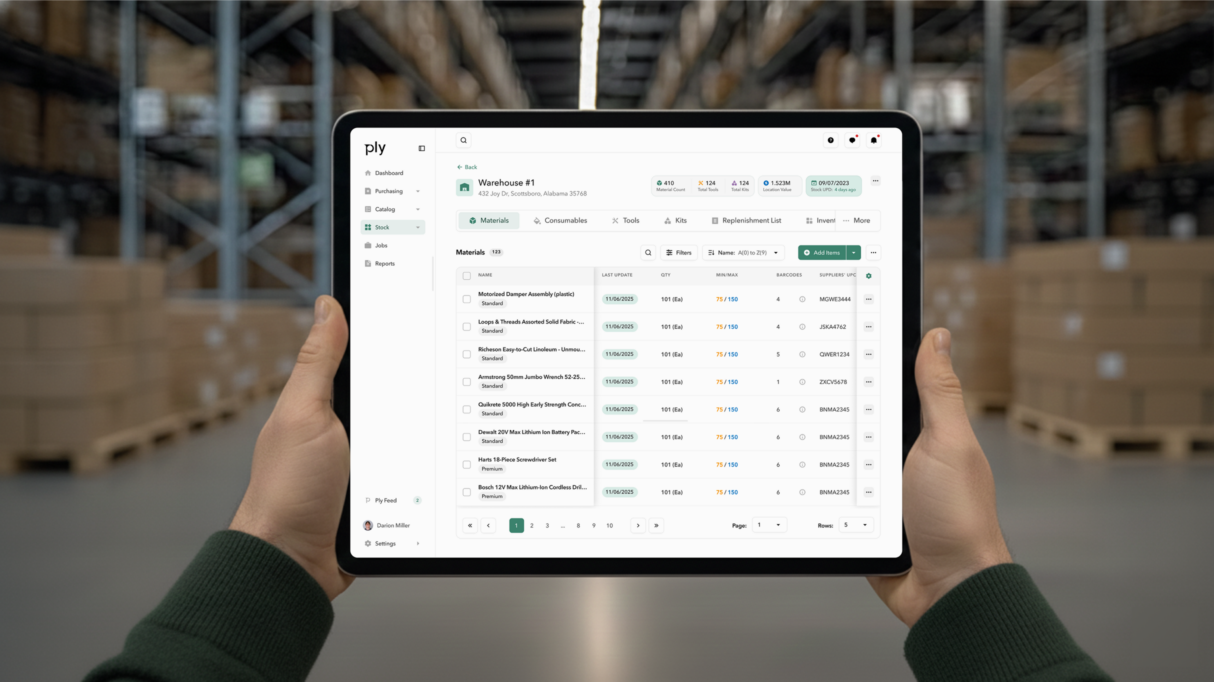

The necessary move is to a cloud-based inventory management system that establishes a single source of truth.

- Unified Visibility: Real-time tracking across warehouses, trucks, and job sites using mobile-friendly scanning immediately eliminates the guesswork. By providing the entire team with instant clarity on stock location and count, you recover the 5 to 10 hours per week previously lost to manual reconciliation and expensive runs.

- Proactive Purchasing: Automation shifts procurement from reactionary guessing to strategic planning. Usage-based reorder alerts and smart minimum/maximum levels ensure you only buy what you need, when you need it, and at the best price. This stops dead stock accumulation before it starts and safeguards your working capital.

By implementing an integrated solution like Ply, your business moves beyond tracking and reacting. It moves to a proactive, data-driven model that maximizes billable time, secures your margins, and allows for scalable growth, converting the thousands you lose monthly into thousands you profit.